One of the intrinsic characteristics of the cryptoasset market is its high volatility, which is a statistical concept that measures the variation that occurs in the prices of crypto assets over a given period of time.

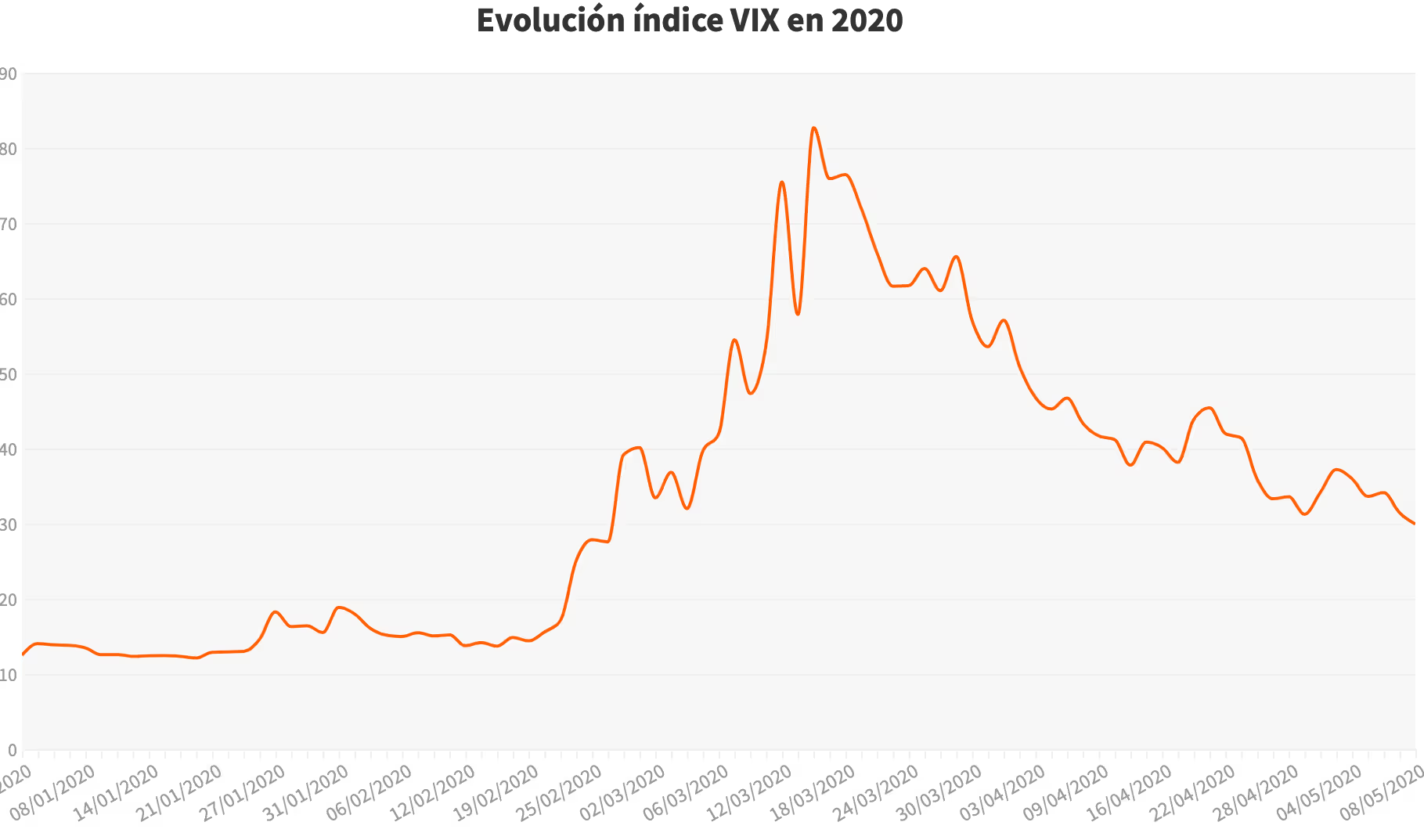

For example, volatility in American markets is measured by the VIX index. It is an indicator that estimates the volatility of the American stock market for the next 30 days. It is considered a sign of market sentiment regarding expected fluctuations.

As a general rule, if the VIX index records movements greater than 25, it is a sign that the market expects higher volatility than usual. Conversely, if it is below 25, it means that the market is stable.

In the previous image, we looked at the history of the VIX index.

VIX, also known as the “fear index”, often referred to as the “fear index”, during heavy trading volume and the downward fluctuation in stock market prices, describes how market risks, fears and stress are evaluated at a given time and in those next 30 days.

In parallel with the traditional world, a volatility index exclusive to the crypto world has just been created, which has the same function. And this is a widespread trend, the fact that decentralized finance adopts the best tools of traditional finance.

This index, called CVI, is created by COTI: https://cvi.finance/platform

In the previous image, we observed the temporal analysis of crypto volatility, where the maximum index is 200.

Therefore, understanding that market volatility is constant, and that Bitcoin is also the dominant cryptocurrency, we must establish volatility control tools.

One of the ways, therefore, to reduce volatility is to opt for tokens that represent a more stable underlying, such as real estate, or a company's Equity. For this case, the added point of investing in real estate assets is that they can acquire value through two complementary ways: rent and sale.

Therefore, compared to the synthetic gold use case, you are not only exposed to the incremental value of the precious metal, but also to future revenues as a productive asset.

After the volatility we have experienced in recent weeks, having different assets can allow for a more robust portfolio with an appearance more similar to a traditional portfolio but with the advantage of the crypto world.

That's where the value of companies like Reental or similar in other sectors can help portfolios and ultimately the ecosystem to enter the crypto world under the traditional concept.

Bibliography:

https://www.ennaranja.com/inversores/bolsa/volatilidad-mercados-vs-riesgo/

https://cviofficial.medium.com/cvix-market-fear-index-for-the-crypto-space-74be7634dd5e