We know that buying a home can be one of the most important financial decisions of your life. But for many, getting a mortgage loan can be overwhelming and confusing. Do you feel lost in the process of applying for a mortgage loan? Are you worried about not choosing the best loan for you and ending up with an unwieldy financial burden?

Not choosing the best mortgage loan can have serious and lasting financial consequences. You may end up paying excessive interest and hidden fees that increase the cost of your mortgage. You may also end up with a monthly payment that you can't handle, which can affect your quality of life and your future plans. Don't let the mortgage loan application process lead you to make a wrong decision that could affect your future.

There are key steps to choosing the best mortgage loan and realizing your dream of owning your own home. Throughout this article, we'll explore the key steps in obtaining a mortgage loan, from preparation to signing the contract. Keep reading to learn more!

What is a mortgage loan?

A mortgage loan is one way to long term loan which is used to buy real estate. The borrower receives an amount of money from the lender that must be returned in regular installments, along with the corresponding interest. The amount of money borrowed is generally a fraction of the value of the property, and the loan is repaid over an agreed period of time.

The purchased property is used as security for the loan, meaning that if the borrower is unable to meet the credit payments, the lender can recover the property to cover their investment.

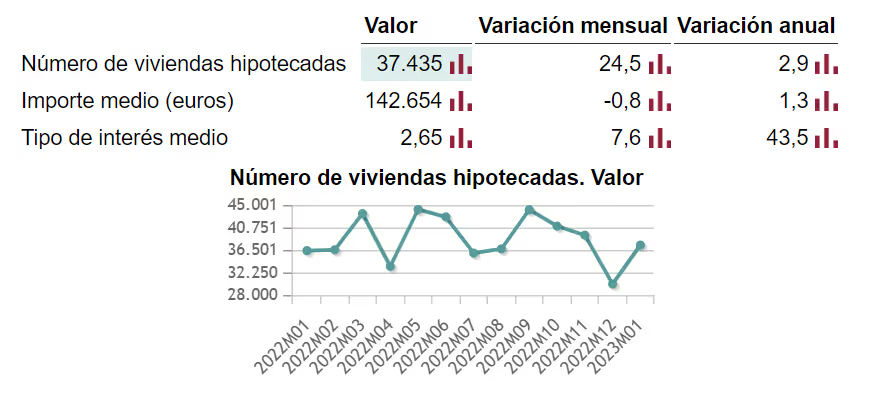

Mortgages constituted on homes. Year-on-year January 2023 (source INE National Institute of Statistics)

Check list what you should do before applying for a mortgage loan

- Review and improve your credit history

- Before applying for a mortgage loan, it's crucial to review your credit history. You can obtain your credit report from the major credit bureaus in your country. Make sure there are no errors and, if you find them, correct them before starting the process.

To improve your credit history, make sure you pay all your debts on time and don't apply for new loans unnecessarily. - Save for a down payment

Lenders generally require a down payment for the mortgage loan. This down payment can vary between 15% and 35% of the price of the property, depending on the type of loan and the applicant's credit profile.

Saving for a down payment is critical, as it can improve your chances of approval and lower your total loan amount. - Evaluate your borrowing capacity

Before applying for a mortgage loan, it's crucial evaluate your borrowing capacity and what is the period that best suits your financial needs. To do this, it is essential to consider monthly income, fixed expenses, and current debts to determine how much you can afford to pay for a mortgage each month.

A useful tool for calculating the term and monthly installments of a mortgage loan is the loan simulator, which is available on most bank and lender websites. This tool will allow you to enter the amount of money you need, the time period in which you want to repay the loan and the interest rate offered by the lender. This way you will know how much you will allocate each month to pay your mortgage payment. If the amount is too high for your budget, you can try to extend the deadline to reduce the amount of monthly payments.

A general rule of thumb is that the monthly mortgage payment should not exceed 30-35% of your net monthly income. - Compare mortgage loan offers

Not all mortgage loans are the same. It is essential to compare the offers of different banks and financial institutions. Pay attention to the interest rate, the interest rate (fixed, variable or mixed), the length of the loan, additional costs, and early repayment conditions.

There are tools and websites that allow you to compare different mortgage loan offers quickly. and simple so you can see the different mortgage loan options that fit your needs. - Prepare the required documentation

Lenders will request a series of documents to evaluate your mortgage loan application. Some of these documents may include: - -Official identification

-Proof of income

-Tax returns

-Bank statements

-Credit history

-Information about the property you want to buy

Make sure you have all the necessary documents before starting the application process. - Apply for pre-approval of the mortgage

Pre-approval is a process in which the bank or financial institution evaluates your financial situation and It tells you how much they would be willing to lend you. Requesting a pre-approval will give you a clear idea of how much you can allow you to spend on a property and will allow you to search for homes within your price range

Key Factors to Consider When Applying for a Mortgage

One of the most tedious processes when applying for a mortgage is to compare different bank offers. To do this, it is crucial to take into account certain key factors that can significantly affect your loan conditions and your long-term finances. To make it easier for you, the team of Reental has made a list of the main factors to consider:

Interest rate:

The interest rate is one of the most important factors to consider when comparing mortgages. A lower interest rate can lead to significant savings over time

Be sure to compare the nominal interest rate (TIN) and the equivalent annual interest rate (APR), since the latter includes the fees and expenses associated with the loan. The Euribor is the most used index as a reference in mortgage lending to calculate the revision of variable interest rates

Currently (April 2023), in the current era of inflation, the Euribor is around 3.5%. You can see its evolution here.

Type of mortgage:

Choosing the type of mortgage is a fundamental decision for your future finances. Briefly, we can say that currently on the market we have:

A fixed mortgage, one in which the same interest rate is applied throughout the life of the loan. They provide you with stability in your monthly payments over time.

A variable mortgage, Unlike the previous one, it has an interest rate composed of a reference rate, which is usually the Euribor, plus a fixed spread, and they can offer savings if market interest rates fall or, on the contrary, large expenses if the rates are very high

Finally, we have the mixed mortgages which combine the previous two, offering the first 10 years at fixed interest and the last 10/20 at variable interest.

Loan term:

The term of the mortgage loan affects both the amount of the monthly payment and the total cost of the loan over time. A shorter term means higher monthly payments, but a lower total cost. A longer term reduces the monthly fee, but increases the total cost due to interest accrued over a longer period.

To decide which amortization period best suits the buyer's profile, the buyer must carry out an analysis of their economic solvency and their borrowing capacity. At Reental, we recommend never exceeding 30% of income

Commissions and expenses:

You should evaluate the fees and expenses associated with the mortgage loan, such as opening costs, notary fees, appraiser fees, and more. All of these costs can vary from entity to entity and can significantly affect the total cost of the mortgage loan.

Early repayment conditions:

Evaluate the early repayment conditions in each loan offer. Some banks charge a commission if you decide to make early payments or cancel your mortgage before the term is due. Compare the conditions and select the option that gives you the most flexibility if you want to reduce your debt ahead of time.

Linking requirements: Some banks offer better conditions if you contract additional products and services with them, such as bank accounts, insurance, credit cards, and others. Consider whether these terms of attachment are right for you and whether additional products offer real benefits.

Other Factors to Consider Before Signing Your Mortgage Loan

Before signing a mortgage loan, It's important to consider other factors that can have a significant impact on the total cost of the loan and the financial peace of mind of your home, such as in many cases home insurance and life insurance, since in the event of the death of the loan holder or total and permanent disability, these insurance covers possible damage or loss that may occur to the property.

Counteroffensive: do not be afraid to negotiate with the bank for better conditions. If you have found a better offer at another bank, you can submit it to the bank that made the offer to you to make a counteroffensive. Many times, the bank will be willing to improve the conditions to win your business. You can also negotiate some aspects of the contract such as Early Cancellation Fees and know the cost of this penalty before signing the contract. Or, agree to a lower down payment.

Conclusion

In short, choosing the best mortgage loan is not an easy task, as there are many factors to consider and compare. However, with the right tools and the necessary information, you can make an informed decision and get a loan that fits your needs and financial possibilities. If you are currently unable to access mortgage credit due to high interest rates, Reental offers you the opportunity to invest from 100€ in a flexible and secure way until you find an attractive rate that suits your needs. In addition, if you prefer not to go through the process of choosing a mortgage loan, Reental brings you closer to the world of real estate investment in a simple and effective way, without you having to worry about property management. In short, Reental is an ideal option for those looking to grow their capital and enter the real estate sector in an innovative and accessible way, such as real estate tokenization.

In order not to miss any of the opportunities we present, we recommend that you join our group of Discord or Telegram To get to know others Reental and the whole team. Of course we invite you to take a look at our articles on the blog to continue informing you.

Welcome to the new way of doing finance, welcome to Reental.